Norway is not the only oil-reliant nation to turn to its sovereign wealth fund to plug the gap in oil revenue Rex

Norway has taken money from its sovereign wealth fund for the first time since it was set up in 1996.

Local newspaper Dagens Naeringsliv said that 6.7 billion kroner, or $780 million, was withdrawn pay for public spending.

Norway usually pumps 200 billion kroner into the account every year. The reversal of fortunes is a signal that the low oil price is taking its toll on the country’s finances.

“The fact that oil revenues would become too small to cover the government budget deficit was assumed from the beginning,” Paal Bjornestad, a state secretary in the country’s Ministry of Finance, told the Wall Street Journal. “Due to low oil prices, this came earlier than expected, but there will still be an inflow to the fund.”

The sovereign wealth fund is also called a rainy day fund because it contains reserves of money that can be used when regular income is disruped or decreased.

The biggest oil and and gas and non-oil and gas sovereign wealth funds in the world

Norway’s sovereign wealth fund contained 7 trillion kroner at its peak thanks to skyrocketing oil prices, which hit over $100 a barrel in 2008. That’s the equivalent to $150,000 for every man, woman and child in the country.

Bjornestad said that it should continue to grow as long as returns outpace government spending, which has a limit of 4 per cent of its value – equal to its long term average returns.

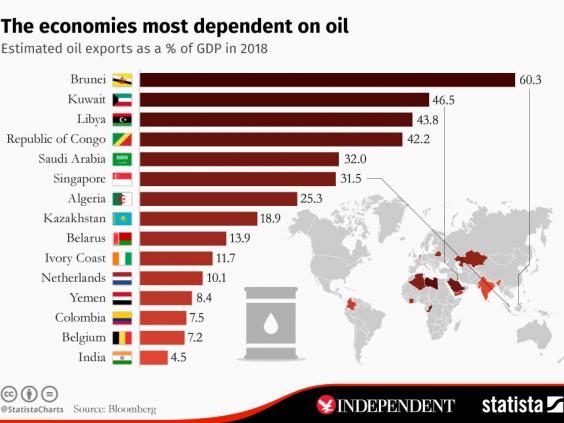

Norway is not the only oil-reliant nation to turn to its sovereign wealth fund to plug the gap in oil revenue. Will the oil price tumbling from more than $100 in mid-2014 to scrape $30 a barrel in more recent weeks, oil exporters are looking for ways to stop swelling budget deficits. Pinching from the rainy day fund has become one popular option.

Russia has reportedly spent 44 per cent of its reserve fund, while Kazakhstan plans to take almost half of its National Fund to try and keep down the government’s deficit in the next three years.

Meanwhile Libya needs the oil price to be somewhere around $207 a barrel to balance its budget. Libya has lost one third of foreign currency reserves worth $120 billion after the fall of Moammar Gaddafi in 2012.

“Sovereign wealth funds were put in place for a rainy day,” Omar Khattaly, head of the Libyan Investment Authority’s $5 billion real estate and hotel portfolio, told Institutional Investor.

“And for many of these governments, the rainy day has come.”

– Originally posted on The independent UK

Leave a Reply